Addressable TV: focus on the viewer

TV advertising is changing, driven by viewing habits and technology. Executed properly advertising on TV is phenomenally effective and there is a huge library of evidence to back this up. It is deeply researched and validated, but what worked 5 years ago is now probably redundant now.

More and more brands are trying TV for the first time. Between 2017-2021, the average number of new-to-TV advertisers a year was 1,003. It’s important to note that these aren’t just huge businesses with budgets to match, 31 per cent of all advertisers spent under £50k on TV and 53 per cent spent below £250k.

So, this is largely driven by brands trying and testing TV and this will continue grow as there are more opportunities. But it does mean we need different rules, using advanced data to target specific groups of people and more evidence to prove effect.

In the analogue world, which was only about 30 years ago, targeting didn’t really matter. It was pretty easy to reach everyone. Over 90 per cent of the population watched ‘live’ commercial TV in a week, almost everyone had an appointment to view. In the early 90’s, bars were strangely empty on early Friday nights because young people stayed in to watch the next episode of Friends at 9.00 pm on Channel 4.

Targeting was relatively straightforward because there was little channel choice; standard strategies against ill defined, broad audiences still delivered awareness. Lager brands targeted young men, consumer goods brands targeted housewives with children and financial services targeted ABC1 adults. These were broad, old-fashioned labels; based on occupational labels from the 1961 census, but it kind of worked, agencies knew roughly where to aim.

It's fundamentally different now. The world has turned on its head; universal, mass coverage is no longer possible and different groups respond to different messages in different ways.

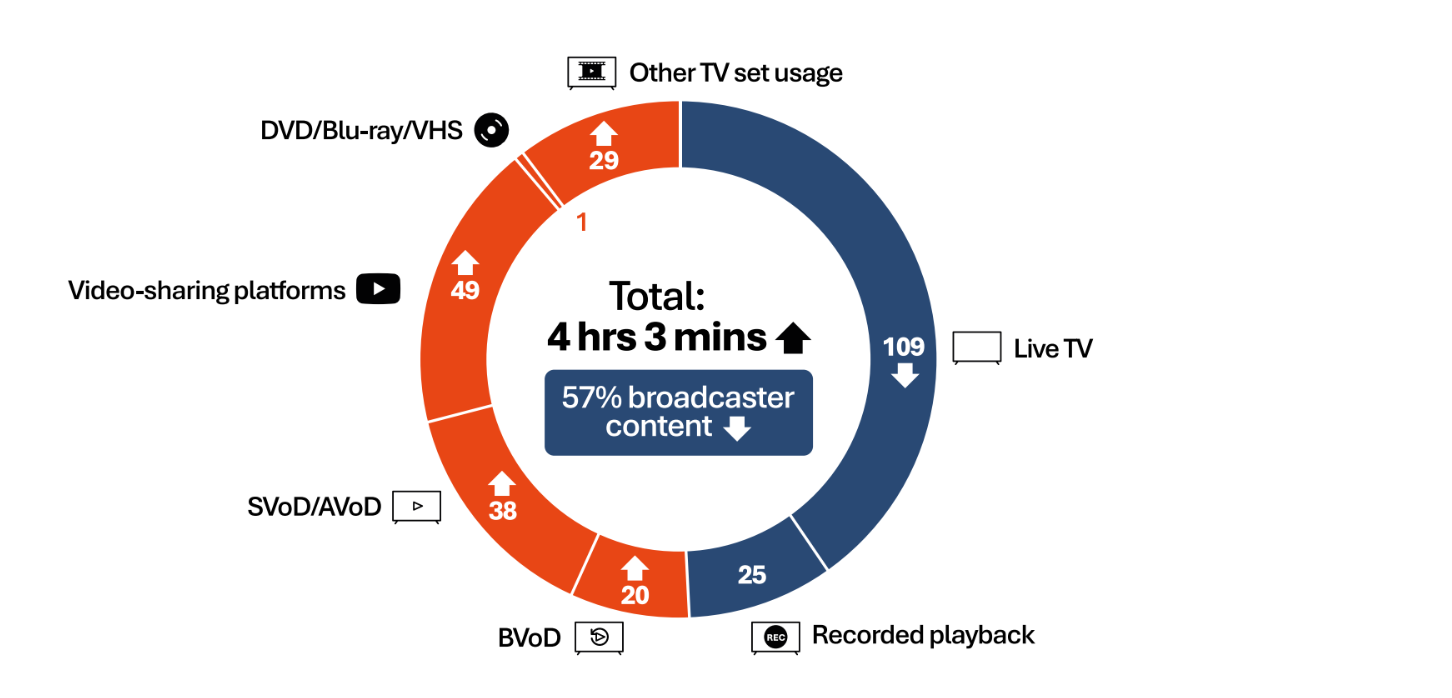

Consumer viewing is spread across a vast array of platforms. Total video viewing a day is still huge, just over 4½ hours for everyone aged over 4 years old. But only 40 per cent of viewing is to live or scheduled TV, and this is predominantly older people.

Less than a fifth of 16-24-year-olds’ viewing is now to free to air broadcasters, compared to nearly 90 per cent for over-64s.

Adults aged 25-34 years old are the heaviest viewers of streaming (or Subscriber funded VoD*/Advertiser funded VoD* services,) at 65 minutes per day, or 28 per cent of their total in-home video time.

However, the fastest growing groups of streamers are 55-74-year-olds and children, both increasing by more than 10 per cent year on year. (This data is from OFCOM in 2024. One thing that we guarantee won’t disappear is the use of acronyms in media, VoD* means video on demand, basically a distribution system that allows users to access videos, television shows and films digitally on request, therefore not scheduled.)

The issue is important; any brand using a conventional, predominantly ‘live’ TV strategy, will run an increasingly greater risk of missing their target audience rather than reaching them, especially if they want to reach younger or more affluent, lighter viewers.

Additionally, a strategy focussed on ‘live’ channels will massively overexpose certain parts of the target audience and fail to reach others.

The old planning ‘rules’ need to evolve; we used to plan to reach 80 per cent of a broad audience in a month. Mass reach is now unachievable, because consumers have migrated to other platforms to view. Hard to reach audiences just don’t watch much scheduled TV.

We are emerging into a post-channel world. 45 per cent of households have 2 or more streaming subscription services, and this doesn’t include catch-up services like ITVX. The attraction of the new platforms is incredibly powerful, but levels of churn are significant and constant. A YouGov survey from April this year showed 31 per cent have cancelled or removed at least one streaming service in the last 12 months. Competition for viewers is intense and will get fiercer as more addressable platforms launch.

Brands need to use robust consumer data to plan future addressable multi-platform campaigns. Amazon, Disney Plus and Netflix plus others are now associate members of Thinkbox, the marketing body for commercial TV in the UK and their audiences are measured by BARB, so the industry is consolidating and becoming accountable. All the major platforms now have broadly similar levels of monthly reach, giving advertisers many options to target specific audiences, targeting simplistic, demographic audiences should become redundant:

| Platform | Monthly reach (%) |

|---|---|

| ITV | 77.6 |

| Channel 4 | 63.9 |

| Sky/NBCU | 55.2 |

| Channel 5/Paramount | 59.4 |

| Netflix | 65.3 |

| Amazon Prime Video | 48.3 |

This is an important shift, as we get a better insight into audience behaviour and more options, it should drive better TV media planning, targeting specific audiences based on first party data.

There is real evidence that TV is no longer mass participation. However hard they try; brands can’t reach everyone. They need to focus on specific cohorts of viewers.

Viewing of mass reach programmes has tumbled; in 2014, nearly 2,500 programmes had an audience of more than 4 million. By 2022, the number had halved to under 1,200. The biggest decline was news programming, which fell by 72 per cent.

The national broadcasters are still incredibly important parts of our social fabric but can be accessed through multiple platforms.

In January 2024 ITV broadcast the four-part drama documentary Mr Bates vs the Post Office. It changed government policy within a week, it probably had a greater effect than any non-sport TV event in the last decade.

The series averaged 9.8 million viewers across all four episodes and the series, including the documentary, and was streamed 16.6 million times on ITVX. This highlights the importance of ‘event’ TV, which only really works on ‘free to air’ channels, but also how important video on demand streaming services are.

No one predicted that it would catch the zeitgeist of the nation, but also, importantly that nearly half the viewers were via what are called ‘FAST’ platforms. Free Ad-funded Streamed Television, which are addressable platforms. This shows Addressable Media doesn’t have to niche.

It shows advertisers have powerful new ways to reach core audiences using addressable TV, they can use first party data to select specific audiences based on product consumption, all platforms offer multiple ways of retargeting through other devices and platforms. Amazon Prime, the second biggest streaming platform, has 12.4 million households paying for a regular subscription, directly linking to a huge retail platform.

The issue is how to use it effectively and simplify a complex process.

Download 'The Retail Accelerator: Achieve business growth with addressable marketing'

Discover how addressable media can transform your retail strategy - download the white paper now.

Office

1st Floor

21 Berners Street

London, W1T 2PX

Be Addressable